Navigating Financial Challenges: Understanding Payment Arrangements With AT&T

Navigating Financial Challenges: Understanding Payment Arrangements with AT&T

Related Articles: Navigating Financial Challenges: Understanding Payment Arrangements with AT&T

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating Financial Challenges: Understanding Payment Arrangements with AT&T. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Financial Challenges: Understanding Payment Arrangements with AT&T

Life throws unexpected curveballs, and sometimes financial difficulties can disrupt even the most meticulously planned budgets. When faced with a challenging situation, navigating the complexities of payment arrangements with a service provider like AT&T can feel overwhelming. This comprehensive guide aims to demystify the process, offering clarity and practical insights to help customers navigate these situations effectively.

Understanding Payment Arrangements

A payment arrangement, often referred to as a payment plan, allows customers to restructure their outstanding balance with AT&T into manageable installments. This option provides a crucial lifeline for individuals experiencing temporary financial hardship, enabling them to maintain essential services without falling into arrears.

Eligibility and Factors Considered

While AT&T strives to assist customers in need, eligibility for a payment arrangement is not guaranteed. The company evaluates each request on a case-by-case basis, considering factors such as:

- Account History: Consistent payment history demonstrates a commitment to fulfilling financial obligations, making it more likely for a request to be approved.

- Current Balance: The amount of the outstanding balance plays a significant role in determining the feasibility of a payment arrangement.

- Financial Situation: Demonstrating the temporary nature of the financial hardship and outlining the steps taken to address the situation increases the chances of approval.

- Previous Arrangements: Previous successful completion of payment arrangements can positively influence future requests.

Initiating a Payment Arrangement Request

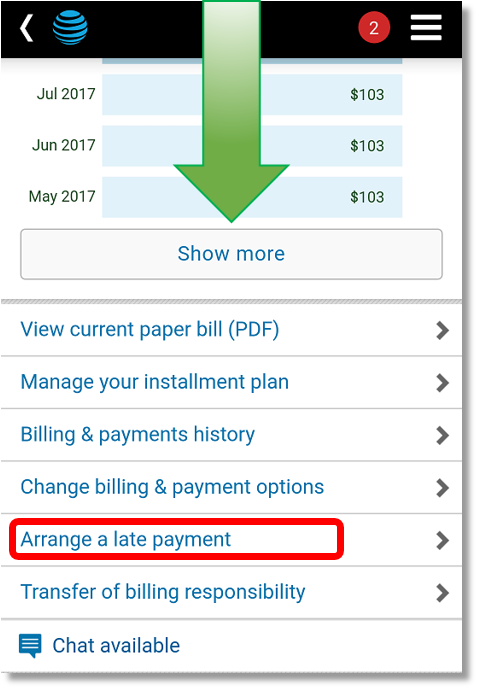

Customers can initiate a request for a payment arrangement through various channels:

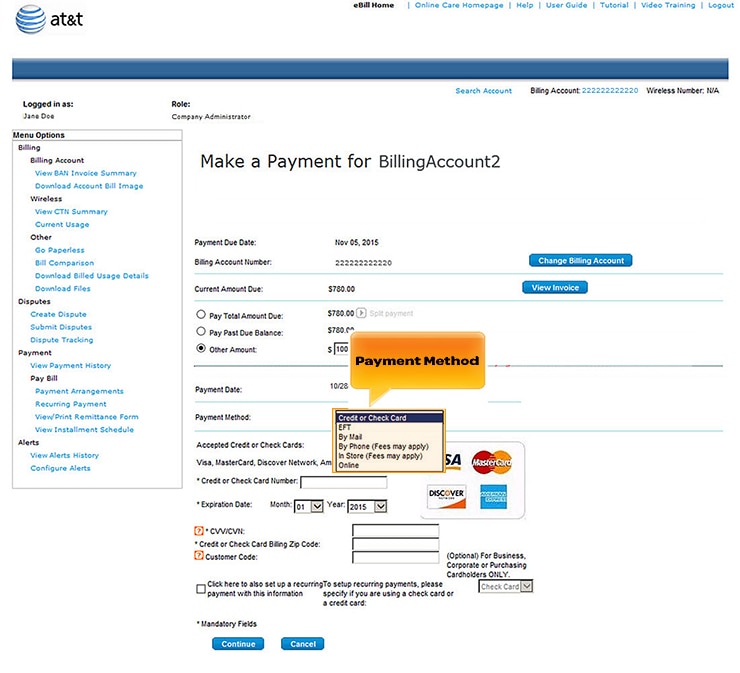

- Online: The AT&T website offers a convenient online portal for managing accounts, including initiating payment arrangement requests.

- Phone: Contacting AT&T customer service directly allows for personalized assistance and guidance throughout the process.

- AT&T Store: Visiting a local AT&T store provides face-to-face interaction with a representative who can assist with the request.

The Payment Arrangement Process

Once a request is submitted, AT&T reviews the information and determines the feasibility of a payment arrangement. If approved, the customer will receive a customized plan outlining the following:

- Payment Amount: The agreed-upon monthly installment amount, designed to be manageable within the customer’s financial capacity.

- Payment Due Date: The specified date on which the monthly payment is due.

- Duration: The timeframe for completing the payment plan, which can vary based on the outstanding balance and individual circumstances.

Maintaining a Payment Arrangement

Prompt and consistent adherence to the agreed-upon payment schedule is crucial for successfully completing the payment arrangement. Failing to meet the payment deadlines can result in:

- Late Fees: Penalties for missed payments may be applied, adding to the overall cost of the arrangement.

- Service Disruption: Non-payment can lead to temporary or permanent suspension of services, disrupting essential communication and connectivity.

Benefits of a Payment Arrangement

- Maintaining Essential Services: A payment arrangement allows customers to retain access to vital services like mobile phone and internet, preventing disruptions to communication and daily activities.

- Avoiding Late Fees and Penalties: By adhering to the payment plan, customers can avoid accruing additional charges, minimizing the overall financial burden.

- Restoring Creditworthiness: Completing a payment arrangement demonstrates financial responsibility, potentially improving credit scores and access to future financial services.

FAQs about Payment Arrangements

Q: What happens if I miss a payment on my payment arrangement?

A: Missing a payment can result in late fees and potentially lead to service suspension. It is crucial to contact AT&T immediately to discuss the missed payment and explore options for catching up on the missed installments.

Q: Can I modify my payment arrangement once it is established?

A: In some cases, AT&T may be able to modify the terms of a payment arrangement based on changed circumstances. Contacting customer service is essential to discuss any potential adjustments.

Q: What if my financial situation worsens after entering a payment arrangement?

A: It is vital to contact AT&T immediately to discuss the situation. The company may be able to offer further assistance or explore alternative solutions to prevent service disruption.

Q: Can I use a payment arrangement to resolve a past due balance?

A: Payment arrangements are primarily designed for resolving current outstanding balances. However, depending on the specific situation, AT&T may consider including past due balances within a payment plan.

Tips for Navigating Payment Arrangements

- Communicate Openly: Promptly and clearly communicate any financial difficulties to AT&T, providing detailed information about the situation.

- Explore Options: Explore all available options, including payment arrangements, hardship programs, or other financial assistance programs offered by AT&T.

- Budget Carefully: Create a realistic budget that incorporates the agreed-upon payment amount, ensuring timely and consistent payments.

- Set Reminders: Utilize calendar reminders or other tools to ensure timely payments and avoid late fees.

- Maintain Records: Keep detailed records of all communication, payment arrangements, and payments made to ensure transparency and accountability.

Conclusion

Facing financial challenges can be stressful, but understanding and utilizing available resources like payment arrangements can significantly alleviate the burden. By proactively communicating with AT&T, exploring all available options, and adhering to the terms of the payment plan, customers can navigate these situations effectively and maintain essential services. Remember, seeking assistance and maintaining open communication with the service provider is key to resolving financial difficulties and regaining financial stability.

Closure

Thus, we hope this article has provided valuable insights into Navigating Financial Challenges: Understanding Payment Arrangements with AT&T. We hope you find this article informative and beneficial. See you in our next article!