Navigating the Dynamic Landscape of the "At Market" Valuation

Related Articles: Navigating the Dynamic Landscape of the "At Market" Valuation

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Dynamic Landscape of the "At Market" Valuation. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Dynamic Landscape of the "At Market" Valuation

The concept of "at market" valuation, often used in financial and investment contexts, signifies a price point that reflects the prevailing market conditions and aligns with the current value of an asset or investment. It is a crucial concept for investors, analysts, and businesses seeking to understand the true worth of their holdings or assets in the ever-shifting market landscape.

Understanding the Essence of "At Market" Valuation

The term "at market" signifies a price point that is considered fair and reasonable based on current market conditions. It is a benchmark used to determine the value of an asset, whether it be a stock, bond, real estate, or any other type of investment. This valuation process considers various factors that influence market sentiment and asset pricing, including:

- Supply and Demand: The interplay of supply and demand for an asset directly impacts its price. High demand relative to supply will drive prices upward, while a surplus of supply will exert downward pressure on prices.

- Interest Rates: Interest rates play a significant role in asset valuations. Lower interest rates often encourage investment and drive up asset prices, while higher rates can make borrowing more expensive, leading to lower asset values.

- Economic Conditions: Economic growth, inflation, and other macroeconomic factors influence market sentiment and investor confidence, thereby impacting asset valuations.

- Company Performance: For publicly traded companies, factors like earnings, revenue growth, and profitability influence stock prices.

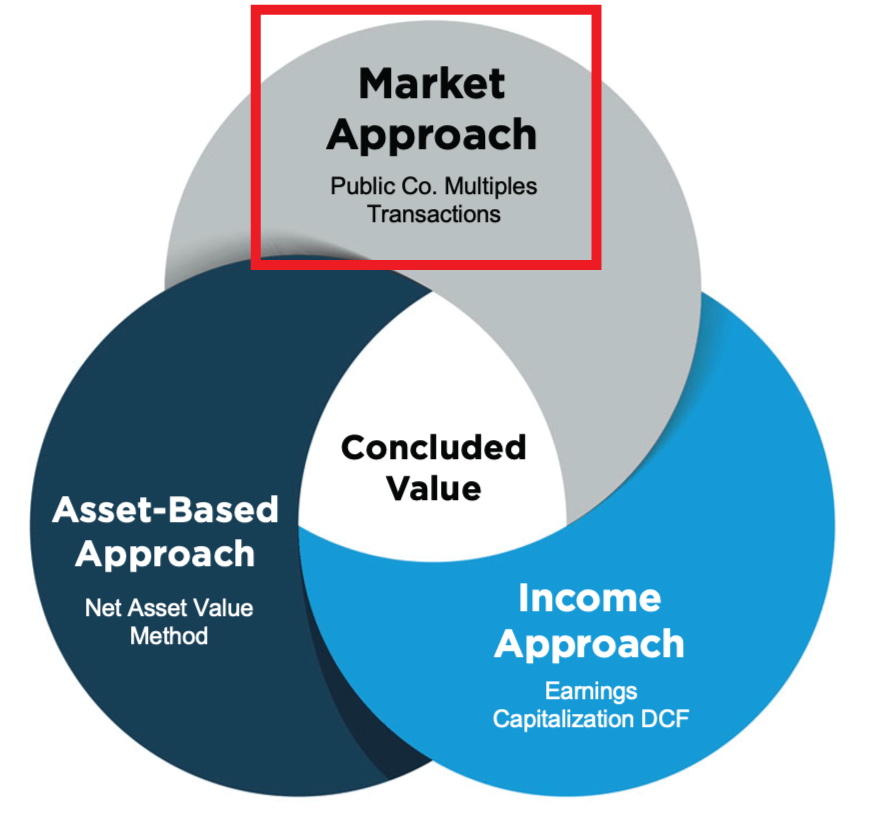

Methods for Determining "At Market" Valuation

Several methods are employed to determine the "at market" valuation of an asset, each with its own strengths and limitations:

- Market Analysis: This method involves studying comparable assets in the market and identifying recent transactions to estimate the value of the asset in question.

- Discounted Cash Flow (DCF) Analysis: This method projects future cash flows from an asset and discounts them back to the present value using a discount rate that reflects the risk associated with the investment.

- Relative Valuation: This method compares the valuation of an asset to similar assets based on key metrics like price-to-earnings ratio (P/E ratio), price-to-book ratio (P/B ratio), or price-to-sales ratio (P/S ratio).

The Significance of "At Market" Valuation

Understanding "at market" valuation is crucial for various stakeholders in the financial world:

- Investors: Investors rely on "at market" valuation to make informed investment decisions, ensuring they buy assets at a reasonable price and sell them at a profitable point.

- Businesses: Companies use "at market" valuation to assess the worth of their assets, including inventory, equipment, and real estate, for financial reporting purposes.

- Lenders: Financial institutions use "at market" valuation to determine the collateral value of assets when providing loans.

- Regulators: Regulatory bodies utilize "at market" valuation to ensure transparency and fairness in financial markets.

Benefits of "At Market" Valuation

- Transparency and Fairness: "At Market" valuation provides a transparent and objective benchmark for assessing asset value, ensuring fairness in transactions and investments.

- Accurate Financial Reporting: By accurately valuing assets, businesses can ensure their financial statements reflect their true financial position.

- Effective Investment Decisions: Investors can make informed decisions by comparing the "at market" value of an asset with its intrinsic value, maximizing potential returns and minimizing risk.

- Enhanced Risk Management: "At Market" valuation allows businesses and investors to assess the risk associated with their investments, enabling them to make informed decisions and manage risk effectively.

FAQs on "At Market" Valuation

1. What is the difference between "at market" valuation and "fair market value"?

While both terms refer to a price point that reflects market conditions, "fair market value" is a more comprehensive concept that considers not only current market conditions but also the specific characteristics of the asset being valued. "At market" valuation is often a simpler, more general measure used for quick assessments.

2. How often should "at market" valuation be updated?

The frequency of updating "at market" valuation depends on the volatility of the market and the specific asset being valued. In volatile markets, frequent updates are necessary to reflect changing market conditions. For more stable assets, updates may be less frequent.

3. Can "at market" valuation be influenced by subjective factors?

While "at market" valuation aims to be objective, subjective factors like investor sentiment and market psychology can influence the perceived value of an asset. This is why it is essential to consider multiple valuation methods and rely on experienced professionals for accurate assessments.

4. What are the limitations of "at market" valuation?

"At Market" valuation is a snapshot of an asset’s value at a specific point in time. It does not account for future events or changes in market conditions that could significantly impact the asset’s value.

5. How can I improve the accuracy of "at market" valuation?

To improve the accuracy of "at market" valuation, consider:

- Using multiple valuation methods: Combining different valuation methods can provide a more comprehensive picture of an asset’s value.

- Consulting with experienced professionals: Seek expert advice from financial analysts, appraisers, or other professionals with expertise in valuation.

- Staying informed about market trends: Stay up-to-date on economic conditions, industry developments, and market sentiment to understand the factors that influence asset valuations.

Tips for Effective "At Market" Valuation

- Identify relevant market data: Gather comprehensive information about comparable assets, recent transactions, and market trends to ensure your valuation reflects real-world conditions.

- Use appropriate valuation methods: Select the most suitable valuation methods based on the type of asset, market conditions, and your specific needs.

- Consider all relevant factors: Account for factors like supply and demand, interest rates, economic conditions, and company performance when determining the "at market" value.

- Perform regular updates: Monitor market conditions and update "at market" valuations periodically to reflect changes in asset value and market sentiment.

- Seek professional advice: Consult with experienced professionals to ensure your valuation is accurate, objective, and reliable.

Conclusion

"At Market" valuation plays a crucial role in navigating the dynamic landscape of financial markets. By understanding the principles behind this concept and employing appropriate valuation methods, investors, businesses, and other stakeholders can make informed decisions, manage risk effectively, and ensure the transparency and fairness of financial transactions. By embracing a comprehensive approach to "at market" valuation, participants in the financial world can navigate the complexities of the market with confidence and achieve their financial goals.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Dynamic Landscape of the "At Market" Valuation. We hope you find this article informative and beneficial. See you in our next article!